Recognizing Animals Threat Security (LRP) Insurance: A Comprehensive Guide

Navigating the world of livestock risk defense (LRP) insurance policy can be a complex undertaking for lots of in the farming sector. From exactly how LRP insurance coverage operates to the different protection choices available, there is much to reveal in this comprehensive overview that can potentially shape the means livestock manufacturers approach threat management in their services.

Just How LRP Insurance Coverage Works

Sometimes, understanding the technicians of Animals Danger Protection (LRP) insurance policy can be complex, yet breaking down just how it functions can give clarity for farmers and breeders. LRP insurance policy is a danger monitoring device created to secure animals manufacturers against unforeseen price decreases. It's important to note that LRP insurance coverage is not an earnings warranty; rather, it concentrates solely on rate threat defense.

Qualification and Insurance Coverage Options

When it comes to insurance coverage choices, LRP insurance coverage offers producers the flexibility to select the coverage degree, coverage period, and recommendations that best suit their threat monitoring needs. By comprehending the qualification standards and coverage alternatives available, animals manufacturers can make informed decisions to manage threat efficiently.

Benefits And Drawbacks of LRP Insurance

When assessing Animals Danger Security (LRP) insurance policy, it is crucial for animals manufacturers to weigh the downsides and benefits inherent in this threat management tool.

One of the main benefits of LRP insurance is its capability to supply defense against a decrease in livestock prices. Additionally, LRP insurance policy offers a degree of flexibility, enabling producers to tailor coverage degrees and plan durations to suit their particular needs.

Nevertheless, there are additionally some drawbacks to take into consideration. One restriction of LRP insurance is that it does not safeguard versus all sorts of threats, such as disease outbreaks or natural disasters. Premiums can occasionally be pricey, particularly for producers with large animals herds. It is critical for manufacturers to very carefully analyze their specific danger direct exposure and monetary situation to figure out if LRP insurance coverage is the best risk management device for their operation.

Comprehending LRP Insurance Policy Premiums

Tips for Making The Most Of LRP Conveniences

Taking full advantage of the advantages of Animals Risk Protection great post to read (LRP) insurance policy requires calculated preparation and aggressive threat monitoring - Bagley Risk Management. To take advantage of your LRP protection, think about the complying with suggestions:

Regularly Examine Market Problems: Keep educated regarding market fads and price fluctuations in the livestock industry. By keeping an eye on these aspects, you can make educated decisions regarding when to acquire LRP insurance coverage to protect against prospective losses.

Set Realistic Insurance Coverage Degrees: When selecting coverage degrees, consider your production prices, market worth of animals, and potential dangers - Bagley Risk Management. Setting practical insurance coverage levels guarantees that you are effectively safeguarded without overpaying for unnecessary insurance

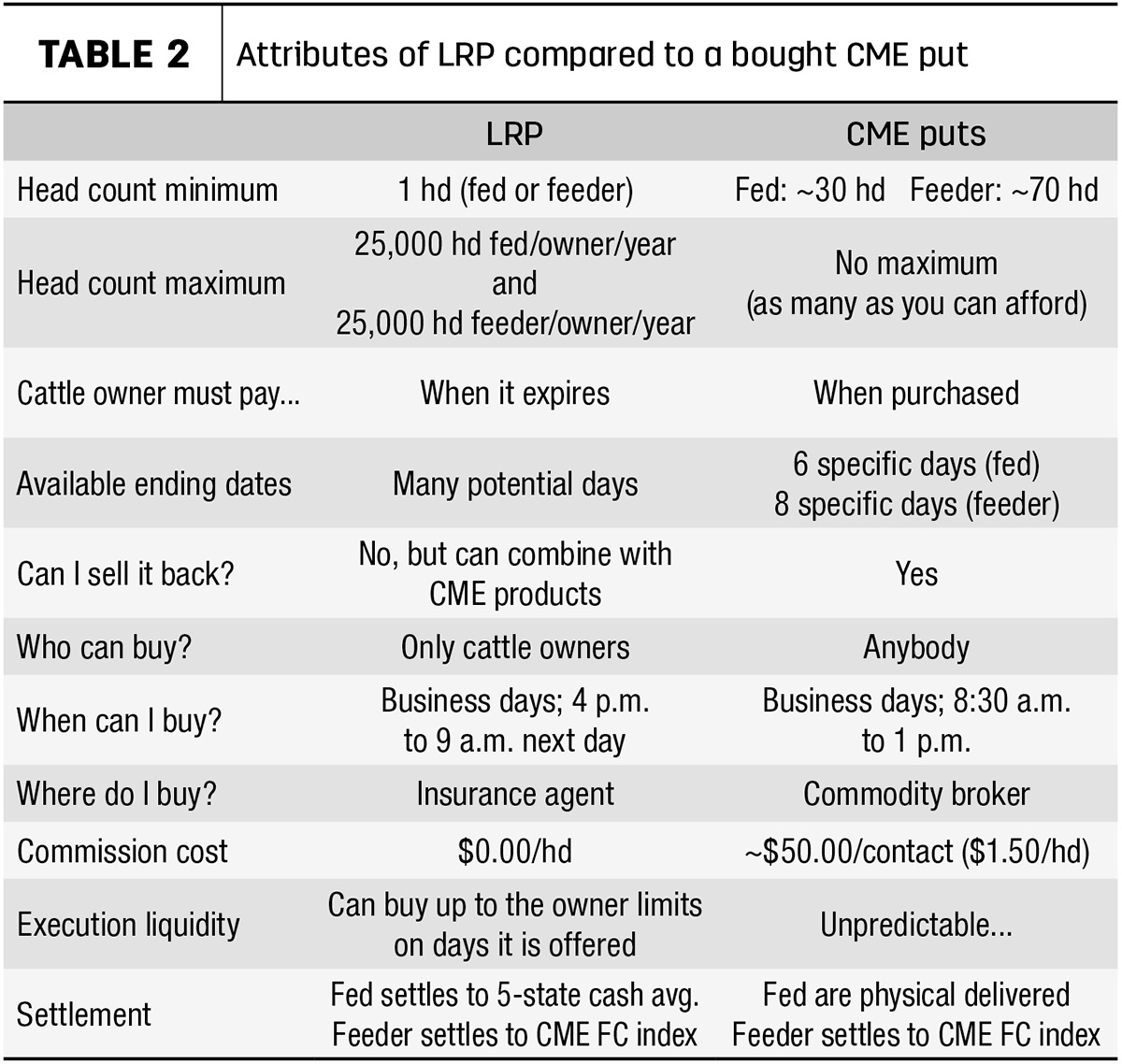

Expand Your Coverage: Rather than counting exclusively on LRP insurance coverage, take into consideration diversifying your threat administration techniques. Combining LRP with various other risk management tools such as futures contracts or alternatives can provide comprehensive insurance coverage against market unpredictabilities.

Testimonial and Change Insurance Coverage Frequently: As market conditions change, occasionally examine your LRP coverage to guarantee it straightens with your present risk direct exposure. Changing insurance coverage levels and timing of purchases can aid optimize your threat security method. By complying with these tips, you can make best use of the benefits of LRP insurance coverage and secure your animals operation against unpredicted threats.

Verdict

In final thought, livestock risk defense (LRP) insurance is an important device for farmers to manage the monetary dangers associated with their livestock operations. By recognizing just how LRP works, qualification and protection alternatives, as well as the advantages and disadvantages of this insurance coverage, farmers can make educated choices to safeguard their resources. By meticulously thinking about LRP costs and applying techniques to make the most of advantages, farmers can minimize potential losses and guarantee the sustainability of their procedures.

Animals manufacturers interested in getting Livestock Risk Protection (LRP) insurance coverage can explore a variety of qualification standards and protection alternatives tailored to their particular livestock operations.When it comes to insurance coverage alternatives, LRP insurance policy supplies manufacturers the adaptability to pick the insurance coverage degree, coverage duration, and recommendations that finest suit their danger administration requirements.To realize the intricacies of Animals Danger Protection (LRP) insurance fully, understanding the elements influencing LRP insurance costs is vital. LRP insurance premiums are figured out by different elements, including the coverage degree picked, the anticipated price of animals at the end of the protection period, the kind of animals being guaranteed, and the length of the coverage period.Evaluation and Adjust Insurance Coverage Frequently: As market conditions transform, have a peek at this site regularly evaluate your LRP protection to ensure it straightens with your present danger exposure.